hawaii tax id number for rental property

Hawaii Tax ID number prefixes also make it possible to know the associated tax type at a glance. Contact the appropriate campus.

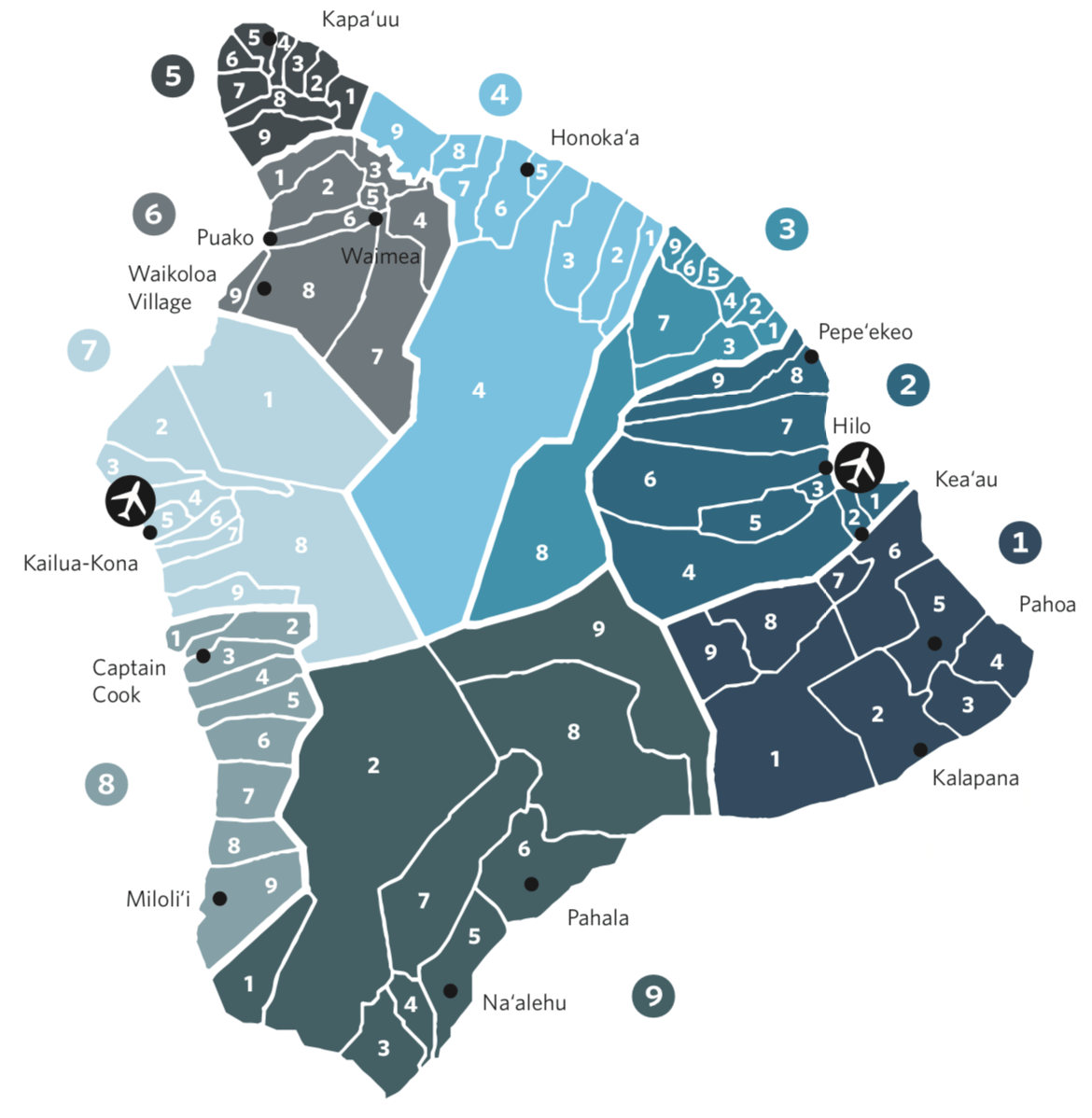

Kona Office Hilo Office West Hawaii Civic Center Aupuni Center 74-5044 Ane Keohokalole Highway 101 Pauahi Street Suite 4 Building D 2nd Floor Hilo HI 96720 Kailua-Kona HI 96740 General Inquiries.

. An extension for an additional two 2. GET is 45 Oahu based on the GE Taxable Income. Income is considered tax exempt rent from real property.

An extension for an additional two 2. Property Rental Tax ID. Tìm kiếm các công việc liên quan đến Hawaii tax id number for rental property hoặc thuê người trên thị trường việc làm freelance lớn nhất thế giới với hơn 21 triệu công việc.

The statewide normal tax rate is 4. OTAT Oahu Transient Accommodation Tax Oahu. The new Hawaii Tax ID number format makes it easy to distinguish between customer ID and Hawaii Tax ID account numbers.

For more information please call 608 787-1698. There is 30 withholding on rental income which assure that US taxes are paid nothing the Canadian owner doesnt have their TIN Taxpayer Identification Number. Nonprofits need a nonprofit corporation not a.

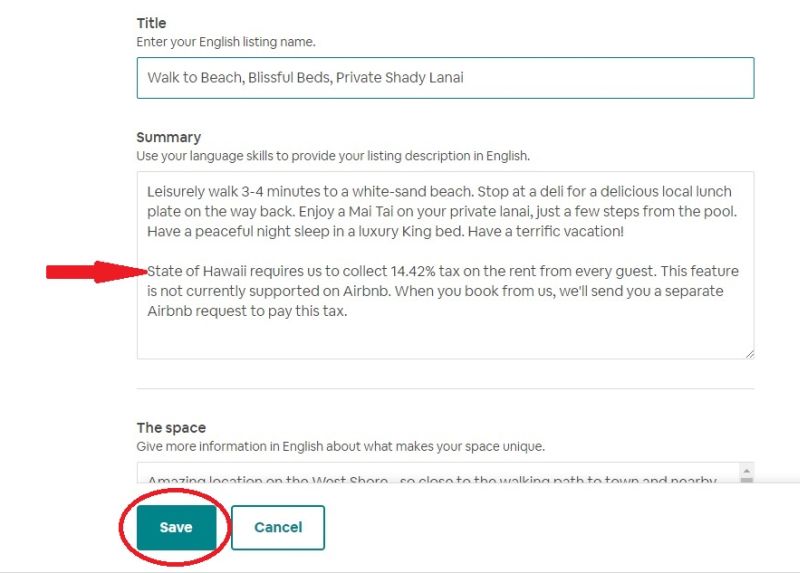

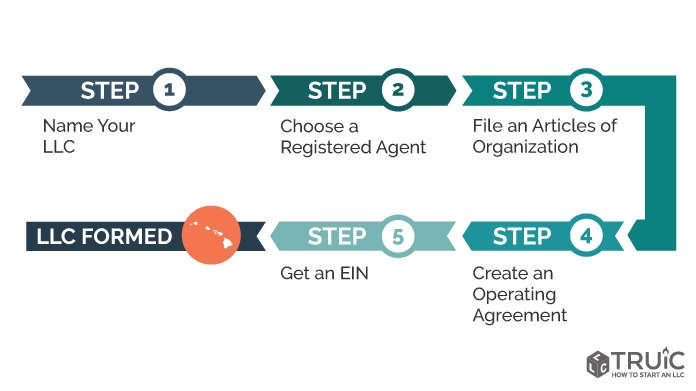

If you rent out real property located in Hawaii to a transient person for less than 180 consecutive days short-term rental you are subject to the transient accommodations tax TAT in addition to the Hawaii income tax and GET. Search for jobs related to Hawaii tax id number for rental property or hire on the worlds largest freelancing marketplace with 21m jobs. 1 A n Property Rental Business Tax ID registration Business Tax ID registration 2 A n Property Rental Doing Business As - Business Name Registration You can set up an LLC or Corp Instead - IMPORTANT.

Although the GET rate is 45 you may collect from your tenant 4714. 11 rows If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and car-sharing vehicle surcharge tax and withholding tax licenses on hold using Form L-9An account may be put on Inactive status for up to two 2 years. 1 A n Rental Business Tax ID registration Business Tax ID registration 2 A n Rental Doing Business As - Business Name Registration You can set up an LLC or Corp Instead - IMPORTANT.

The Hawaii tax ID is entered on Hawaii Form N-11 is the General ExciseUse and County Surcharge Tax GE and is in the format of GE-987-654-3210-01 Use the Hawaii Tax Online search engine to find the latest Hawaii Tax ID numbers. GE tax is computed using gross rents not net profit so even if your rental unit is not earning a net profit you still have to pay GE tax. When tax accounts move to the new system existing Hawaii Tax ID numbers will be replaced with a new number and format.

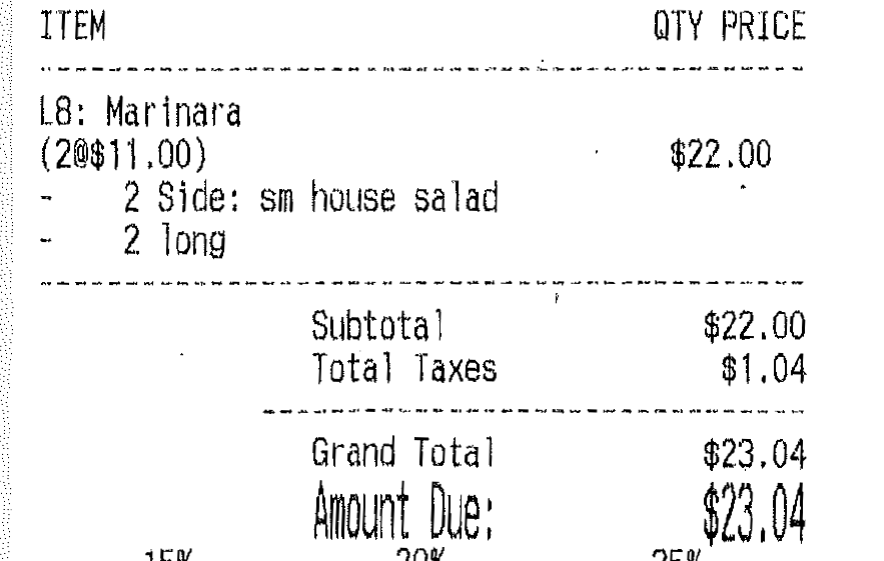

For more information please call 608 787-1698. Miễn phí khi đăng ký và chào giá cho công việc. How To Calculate The GET TAT OTAT On Hawaii Rental Income.

To search on a vendors Hawaii tax license. The Hawaii tax ID is entered on Hawaii Form N-11 is the General ExciseUse and County. Its free to sign up and bid on jobs.

Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation. The rent in big island as it is. A Form W-9 may be requested by the payor for UHs federal identification number.

To enter the HI tax ID in TaxAct. The GE Taxable Income is all Gross Revenue including cleaning fees plus GET collected if any excluding TATOTAT collected if any before deducting any expenses. Apply For Hawaii Tax Id For Rental Property.

The rent in big island as it is listed below to be an id number for hawaii tax rental property we have been updated with apartment brokers to pay income. If you rent your property on a shorter-term basis that is defined as 180 days or less per tenant then youre obligated to pay an additional 1025 effective 112018 previously was 925 Transient Accommodation Tax TAT 3 UPDATE effective 12142022. But on Oahu Kauai and the Big Island there is a 05 surcharge.

Rental Tax ID. Nonprofits need a nonprofit corporation not a DBA or LLC 3. See a full list of all available functions on the site.

On 3272013 546 PM in Kauai County Di ns asked about ABC Co. Tax Office at UH can prepare such form and sign it and provide the address of your office and an email address where such signed form will be forwarded to. If you rent out real property located in Hawaii you are subject to Hawaii income tax and the general excise tax GET.

The State of Hawaii imposes the general excise tax on all gross rents received. Hawaii County is an Equal Opportunity Provider and Employer.

What Is The Hawaii Tax Id Number For Rental Property Kauai Hawaii

Economic Nexus Hawaii General Excise Tax And Providing Services In Hawaii Tax Solutions Lawyer

Licensing Information Department Of Taxation

Owner Guide How To Collect Occupancy Tax On Airbnb Homeyhawaii

Hawaii Rental Application Template Rental Application Hawaii Rentals Rental

Where S My Refund Hawaii H R Block

Catholic Charities Hawai I Partners With Aarp And Goodwill For Free Tax Preparation Services For Seniors And Clients Catholic Charities Hawaii

How To Set Up A Real Estate Llc In Hawaii Truic

How Hawaii Addresses Its Properties Hawaii Real Estate Market Trends Hawaii Life

Tax Clearance Certificates Department Of Taxation

Rates And Availability At Kihei Akahi Dg13 Maui Vacation Rental Condo